Russia vs. the West: The Economic Battle for Ukraine

Introduction and Theory

Scholars have long realized that economic leverage can be a powerful tool in international relations, whether used as a ‘stick’ or ‘carrot.’ 1 However, most of the existing literature on economic sanctions is rooted in the implicit assumption that a few wealthy states—the United States (U.S) and its Western allies—will be able to impose sanctions with impunity on smaller, weaker states. Almost all of the classic cases considered in the sanctions literature are of this type, focusing for example on sanctions by the U.S. and Europe against North Korea, Cuba, South Africa in the Apartheid era, Iraq under Saddam Hussein, and Yugoslavia under Slobodan Milosevic. 2 While the literature has innumerable studies of these cases, sanctions by non-Western actors are much more rarely considered. For example, this bias is seen even the most authoritative study of sanctions (Hufbauer, et.al., 2007). This work focuses on 174 cases of sanctions since 1914. Yet over two-thirds of the cases chosen involve the U.S. as initiating country (118 out of 174). When cases initiated by the E.U. countries are included, we see that 145 of 174 cases (over 83%) are Western-based. The main focus of this literature has been on how the sanctions can be made more effective. How can other Western countries and the United Nations (UN), be induced to support sanctions? Can the sanctions be made ‘smart,’ by better targeting of vulnerable economic sectors and key leaders (Cortright & Lopez 2002)?

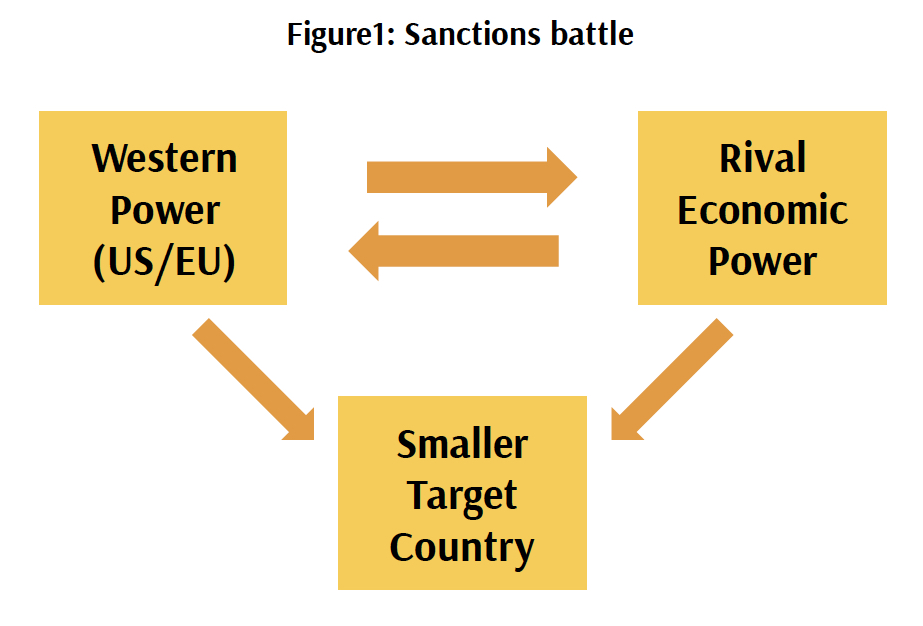

This casual assumption of Western economic hegemony ignores some of the lessons of history. For example, before the Second World War, countries such as Nazi Germany and Imperial Japan represented formidable adversaries, not only for their military might but for their economic power, which enabled them to manipulate their neighbors and to fight back against Western sanctions.3 Even during the Cold War, although the Soviet Union and its allies clearly had less economic clout than the West, they could still use economic aid and trade to try to counter Western policies.4 Today, as the world again becomes more multipolar, we can no longer focus on only unidirectional sanctions with the West targeting isolated, weak countries. Authors such as Blackwill and Harris (2016) have made it clear that the new era of ‘geoeconomics’ will be much more challenging. States such as China (now the world’s second largest economy) and Russia (one of the world’s largest oil and gas producers) clearly have the economic clout to resist Western sanctions—and impose sanctions of their own, both against weaker target states and against the West itself. Thus, as in the Ukrainian case, analysts may have to consider up to four distinct strands of sanctions (see Figure 1). The West may be targeting a small state with either aid or sanctions, and a strong economic rival may be targeting that state as well. Yet at the same time, the two larger powers may be sanctioning each other.

How can we best evaluate the effectiveness of sanctions? Even for a single strand of sanctions this remains controversial, let alone for multiple conflicting sanctions. Some in the literature argue that sanctions rarely work while others see them as very useful.5 Sanctions advocates like David Baldwin (1986) have long pointed out that harming the target state economically is a form of success. Yet even this effect is not always easy to measure. Perhaps the most obvious indicator of economic impact would be an overall decline in the country’s Gross National Product (GNP). Yet this may not be obvious in the short term, and may be caused by many other factors. One can also look at measures such as the target state’s trade and capital flows and the value of its currency and stock market.

However, even if sanctions do cause economic pain, they may not result in political compliance by the target state. The classic study by Hufbauer et al. (2007) estimates that, at most, only one third of sanctions attempts result in compliance. And if a state does change its policies, it will have a large incentive to deny that the change has resulted from foreign pressure, since it does not want to appear weak. As we shall see, there is a lively debate on whether the West’s sanctions against Russia in the Ukrainian case have had any real impact on the Kremlin’s policies.

One problem for the West, then, is that it may now face a more complex world, where multiple sanctions must be evaluated, since hostile, economically powerful states can counter Western sanctions with their own. However, a second problem for the West should also be of concern. Different types of governments respond differently to sanctions. For example, scholars have noted that democratic regimes may be more vulnerable to economic pressure than non-democratic ones (Lektzian & Souva 2007). Democratic leaders must listen more to public opinion, and must fear losing elections if the public turns even slightly against them. One of the most well-documented theories in Political Science is the economic theory of elections. Many studies have shown that if a country’s economy falls by 1%, the vote share of an incumbent leader will decline by about 2% (Markus 1988; Bartool & Sleg 2009). This fact sometimes works to the West’s advantage—if it is trying to sanction a state with competitive elections. Such has been the case with Iran, which agreed to curb its nuclear ambitions in large part because of sanctions (Newnham 2011a). Its current leader, Hassan Rouhani, is well aware that a major reason for his election was public anger with economic stagnation due to sanctions, and he thus had a mandate to change Iran’s foreign policy. However, the West generally is trying to sanction authoritarian regimes, which can only be overthrown when popular anger is much greater. The ‘cost’ of opposing Vladimir Putin in Russia is much higher for an average citizen than the cost of voting against Rouhani in Iran, or Barrack Obama or Donald Trump in the U.S. This could be a problem for the West in the Ukrainian case. Both Ukraine and the Western countries themselves, as democratic states, may be more vulnerable to sanctions than Russia.

Also, authoritarian leaders, with their control over the news media, may be better able to provoke what is known as a ‘rally "round the flag"’ effect (Galtung 1967; Eland 1995). If a country is being sanctioned, the public may ignore economic hardship and, in a burst of patriotism, support national leaders even more strongly, at least in the short term. As we shall see, this seems to have happened in Russia after Western sanctions were introduced, which will make it difficult for Western sanctions against Moscow to be effective in the immediate future.6

This paper will proceed as follows. First, I will try to evaluate the power of Western economic leverage. Of course, a key focus will be sanctions against Russia which have been rolled out in several phases starting in spring 2014. However, it must be remembered that the West, like Russia, has sought for years to use both sanctions and incentives to influence Ukraine. Thus, the ‘economic battle for Ukraine’ in fact began well before the outbreak of the current crisis. Next, I will consider Russia’s economic power and its impact. Russia has long tried to use its economic strength to win over Ukraine. For years it has offered various forms of economic aid to pro-Russian leaders there, while punishing pro-Western governments. This pattern escalated greatly as the present crisis unfolded. By summer 2014, as the West began to sanction Russia, the Kremlin retaliated with its own economic attacks on the U.S. and its allies. Finally, the paper will attempt to draw some conclusions and will present policy recommendations.

Western Economic Power and Ukraine

Most outside observers noticed the ‘economic war for Ukraine’ only in the spring of 2014, when the West began to impose sanctions on Russia after its armed intervention in the Crimea. However, in fact the U.S. and the European Union (E.U.) have been working to promote their agenda in Ukraine for some time. Perhaps most notably, the E.U. has long included Ukraine on its list of Eastern partners, steadily forging closer ties with Kyiv. This has encouraged pro-Western forces in the country to dream of eventual E.U. membership, although that prospect still seems distant. The E.U. first signed a Partnership and Cooperation Agreement with Ukraine in 1994 and followed up by including the country first in its Neighborhood Policy and then in the deeper Eastern Partnership in 2009.

The E.U.’s efforts represented a substantial economic incentive to Ukraine to look to the West. If full E.U. membership could be achieved, Ukraine could benefit from the large, wealthy E.U. market for its agricultural and industrial goods. Its people could study and work in the E.U., where salaries are vastly higher. The country could qualify for a cornucopia of E.U. subsidies and grants.7 Kyiv would receive administrative help, to improve government efficiency and cut corruption. The E.U. companies would be encouraged to invest in Ukraine, taking advantage of lower salaries and underused factories while still being able to produce within the E.U. zone.8

The potential impact of these changes can be seen dramatically just across the country’s Western border. Poland and Ukraine had roughly the same standard of living when Communism collapsed in Eastern Europe 25 years ago. Now, however, over ten years after joining the E.U., Poland’s per capita GNI (Gross National Income) is almost four times that of Ukraine.9 Recent historical memories make this comparison all the more striking for those living in Western Ukraine. The Galicia region, for example, centered on Lviv, was linked to Poland for centuries. It was part of the Polish-Lithuanian Commonwealth, then the Austro-Hungarian Empire, and finally interwar Poland until 1939. After Ukrainian independence it was only natural for many in that country to look with envy at the surging growth across the nearby border.

In fact, it was the power of the E.U.’s economic influence that precipitated the current international crisis over Ukraine. President Victor Yanukovych, considered friendly to Moscow, found the lure of the E.U. ties so irresistible that he surprisingly agreed to an Association Agreement with the Union, which was to be signed in November 2013. When threats and economic pressure from Moscow forced him to back out of signing the pact, pro-Western demonstrations erupted that eventually led to his downfall in February 2014. Not surprisingly, those demonstrations featured many Western Ukrainians, especially those from the Lviv region.10 The political impact of the E.U. was dramatized when the protesters christened their demonstration on Maidan Square in Kyiv as “Euro-Maidan” and adopted the E.U. flag as their symbol. The West increased the pressure on Yanukovych by threatening sanctions against his top associates: the U.S. imposed visa bans, and on February 21, 2014, just before the Ukrainian government fell, the E.U. imposed both visa bans and asset freezes (2014, ‘EU imposes Ukraine sanctions after deadly Kiev clashes,’ BBC News, 21 February).

With the fall of Yanukovych and the installation of a pro-Western provisional government both the E.U. and U.S. moved to deploy economic instruments to help Kyiv’s beleaguered rulers. The E.U. quickly announced, in April 2014, that more Ukrainian products would be allowed into the E.U. duty-free (Regulation EU no. 374 2014). The E.U. also signed the delayed Association Agreement with the new Ukrainian government on June 27, 2014. It contained a Deep and Comprehensive Free Trade Agreement which Kyiv hoped would help it to reorient its trade away from Russia.11 Both the E.U. and U.S. also announced financial support for the struggling Ukrainian government. The E.U. quickly offered a package of 11 billion euros. The International Monetary Fund (IMF) stepped forward with another $17-18 billion in financing (European Commission 2014; Mayeda 2015). This aid was partly intended to cushion the country from considerable economic blows from Russia, which will be detailed below. The Ukrainian government at the time was pinning its hopes for survival on an economic reorientation toward the West. This was evident in President Poroshenko’s selection of Aivaras Abromavičius, a Lithuanian citizen, as his Minister of the Economy, an American, Natalie Jaresko, as his Finance Minister, and the pro-Western former leader of Georgia, Mikheil Saakashvili, as Governor of the Odesa region. However, the efforts of Poroshenko and the West did not pay off immediately: the World Bank estimated that the Ukrainian GDP may have fallen by up to 12% in 2015, after a 7% fall in 2014, and inflation peaked at 61% in mid-2015 (World Bank 2015). There was a modest recovery in 2016, with a 2% rise in GNP, but the country remains in deep economic trouble. Overall, then, the West’s aid to Ukraine may have helped to win the country to its side politically—but has not, at least yet, succeeded in healing its economy.

Western Economic Power and Russia

While the U.S. and the E.U. worked to strengthen the new pro-Western government in Kyiv, Russia intervened against Ukraine using both military and economic instruments, as will be detailed later in this article. This, in turn, led the West to open a new front in the economic battle for Ukraine—sanctions against Moscow. Thus far there have been three major rounds of sanctions. And there may be more. At the G-7 summit in Germany in June 2015, the assembled leaders agreed to plan further sanctions if Moscow did not halt its interference in Eastern Ukraine. The summit’s final communiqué warned that 'we stand ready to take further restrictive measures in order to increase the cost to Russia should its actions so require' (Carter & Cole 2015).

The E.U., the U.S., and their partners have thus far employed similar, coordinated sanctions against Moscow. Throughout this effort, these powers have been at pains to follow the careful 'smart sanctions' approach advocated by authors such as Cortright and Lopez (2002) and Maureen O’Sullivan (2003). Many noted the disastrous social consequences of the wholesale sanctions against Iraq from 1990-2003. Forbidding Iraq to export oil impoverished the country, leading to negative consequences such as spikes in infant mortality. Furthermore, the experts believed, such wholesale sanctions—as also practiced for years against North Korea and Cuba—merely angered the target state’s population, driving them closer to their rulers. Thus the sanctions against Moscow seemed designed to reduce ‘collateral damage.’ Instead of banning a major Russian export or denying Russia large-scale imports—measures which would hurt whole areas of the Russian economy and also hurt the profits of many Western firms—the West turned first to targeted financial sanctions against companies and individuals closely associated with President Putin. These were gradually expanded to sectoral sanctions against financial and energy firms.

The first round of sanctions, announced in March 2014 when Russia began its incursion in Crimea, was quite limited. The West suspended ongoing talks on increased economic cooperation with Russia. Some individuals involved in the Crimean operation were targeted. The U.S. initially issued travel bans and asset seizure orders for 11 individuals, while the E.U. targeted 21, many of them lower-ranking (Myers & Baker, 2014). In addition to punishing these individuals, it was hoped that two more effects would make themselves felt. First, the measures might help induce those targeted to begin to quietly lobby President Putin to mend his ways. Second, Washington and Brussels hoped that, despite the small size of the initial sanctions, they would frighten risk-shy investors, weakening Russia’s currency, stock market, and overall investment climate.

When Russia moved beyond the Crimea and began to support secessionist forces in Eastern Ukraine, a second round of sanctions went into effect in late April. This lengthened the list of targeted individuals, including such prominent names as Igor Sechin, the Chairman of Russia’s most valuable oil company, Rosneft. It also went beyond individuals for the first time, adding some Russian corporations and banks that were seen as especially close to President Putin’s inner circle, such as Rostec, SMP Bank and InvestCapital Bank (Baker 2014).

Finally, in the summer of 2014, the West moved to a third round of sanctions. By now Putin’s support for the Donbas rebels had become clearer, and the West was especially revolted when the rebels downed a Malaysian jetliner over the conflict zone, killing almost 300 innocent civilians—over two-thirds of them from the E.U. Accordingly, in July the West added a number of names to the list of those facing individual sanctions, and also added several important Russian banks (Sberbank, VTB Bank, Russian Agricultural Bank, Gazprombank and Vneshekonombank) and state-owned oil companies (Rosneft and Novatek). The export of any dual-use technology to Russia was prohibited. And for the first time whole sectors of the Russian economy were targeted, albeit in a limited way. For example, it was agreed that certain kinds of oil-drilling equipment could not be shipped to Russia and that new Western investment in that sector should be limited (Borger, Lewis & Mason 2014).

However, Russia not only persisted in aiding the Donbas rebels, it intervened in the conflict with its own army—albeit in a still ‘masked’ way, with Russian tanks being marked with the flag of ‘Novorossiya,’ for example. Russia’s action, at the end of August, turned what had seemed a likely victory for Kyiv in the disputed region into a rout. Accordingly, in September the West reacted by tightening sanctions still further (Council of Europe 2014). Finally, with the weakening of the September 2014 Minsk ceasefire agreement in late 2014, the West moved to add still more sanctions. While a large new ‘fourth round’ was not yet forthcoming, the E.U. did add some additional names to the list of sanctioned individuals in January 2015 and announced that further measures were being studied (2015, ‘Ukraine conflict: E.U. extends sanctions against Russia,’ BBC News, 29 January). Since then, the sanctions have been renewed every six months. While the Trump administration is widely viewed as less sympathetic to the sanctions, thus far it has not changed them.

Evaluating the Effects of Western Sanctions

Have the West’s sanctions against Moscow been successful? In examining this key question, several aspects of the sanctions’ impact should be considered: first, their effect on the target state’s foreign policy actions. Second, their effect on its economy. And third, their effect on its domestic politics.

Some would argue that the sanctions have had little impact on the Kremlin’s foreign policy. Russia continues to keep a firm hold on Crimea and to assist rebels in Eastern Ukraine. Others argue that the current sanctions—and fear of yet stiffer penalties in the future—have helped to press Russia toward a diplomatic solution. They note that the Kremlin was very reluctant to commit its own forces in Eastern Ukraine, instead long preferring to merely aid weak local rebels—a strategy which came very close to failure in August 2014, when the Ukrainians nearly wiped out the insurgency. And when Russia did briefly intervene itself, to save the rebels from defeat, it was very quick to ask for a ceasefire and withdraw most of its forces—and at least in part, sanctions supporters say, to forestall further sanctions. President Putin was probably correct to say, in a controversial phone call with the President of the European Commission, José Barroso, 'if we want to, we can take Kyiv in two weeks' (Roth 2014). Yet instead, the Kremlin has largely contented itself with protecting the small rebel areas in the East, in effect—one could argue—conceding the rest of the country to the West. As we shall see below, another indication of the success of Western sanctions is the fact that Russia has felt compelled to resort to costly and controversial measures to counter them, including embargoes on Western food imports and a law to compensate wealthy oligarchs who were harmed by the sanctions.

While the impact of sanctions on Russian foreign policy may still be debatable, sanctions supporters can point to greater effects in the second area mentioned above—the Russian economy. These economic consequences have been sharply increased by the fortuitous timing of a major downturn in global oil prices, Russia’s main export. From June 2014 to January 2015 the price fell from about $110 to $50 per barrel. It then fell even lower, reaching $32 in early 2016, before stabilizing at around $50. Agencies such as the IMF have downgraded their predictions for Russia’s growth rate several times. After three rounds of sanctions, the IMF was predicting by fall 2014 that Russia would grow at most by 0.2% for that year. In October the E.U. projected that Russia would lose 1.1% in growth due to the sanctions in 2015, after losing 0.6% in 2014 (Norman 2014). Later forecasts were even more negative, as the slowdown has accelerated. A more recent estimate by the World Bank was that the country’s GNP fell by 3.8% in 2015 and would decline by a further 1-1.5% in 2016 (Razumovskaya 2016).

In the short term, the sanctions helped induce capital flight, with both foreign investors and Russians transferring funds out of the country. It was estimated that about $150 billion left the country in 2014, a serious burden when one considers that the total value of the Russian economy is about $2 trillion. This was double the figure for 2013 (2015, ‘Russia capital flight surges,’ Eurasianet). While that drain slowed in 2015, new investment essentially stopped. Russia’s anti-Western countermeasures, discussed below, have only accelerated the process. Why, for example, would McDonalds want to continue to invest in a country which arbitrarily closes its restaurants for "health violations" whenever there are political tensions between Washington and Moscow? (Matlack 2014). The same obviously applies to Western media companies, who are now being told they can own only 20% of any Russian media property (Sonne 2014). This is to say nothing of Western oil companies, who—because of the nature of their business—must commit vastly larger sums for a very long time period. Even in areas where sanctions permit investment, fears of future sanctions or Russian retaliation have effectively cut off financial flows. Net Foreign Direct Investment has plunged. World Bank figures show that Russia had net FDI inflows of $69.2 billion in 2013, $22 billion in 2014, and only $6.9 billion in 2015 (‘World Development Indicators Databank: Russia,’ The World Bank). This will have a real effect on the Russian economy in the medium and longer term.

A range of other indicators confirm the gloomy outlook for the Russian economy after sanctions were imposed. The rating of Russia’s sovereign debt was steadily downgraded, reaching ‘junk’ status in early 2015. This not only raises the country’s cost of borrowing, it also forces many investment funds to sell Russian bonds, as they are not permitted to hold non-investment grade bonds (Korb & Tana 2015). The Russian stock market plunged. By December 2014 the RTS index stood at about 700, a fall of two-thirds from its value in 2011. Inflation surged; in March 2015 it reached a rate of 16.9% per year, and it remained above 15% until December (Tanas 2015). Even more dramatically, the Russian ruble seemed near collapse. On December 16, 2014, a euro cost 91.5 rubles (European Central Bank Statistics). This had two further negative effects for Russia. First, the government began to run down its hard currency reserves in an attempt to support the ruble. The government spent almost 40%of its liquid reserves from July 2014 to April 2015 (DeFotis 2015). And second, in a desperate bid to induce investors to keep money in the country, interest rates were raised sharply, leaping from 10.5 to 17% near the end of 2014. This seemed to have little immediate effect on capital flows, but did further harm struggling Russian businesses. In the few sectors which could potentially benefit from the ‘sanctions war’ with the West—for example, domestic producers of high quality foodstuffs, which Moscow now refuses to buy from Europe—businesses found it almost impossible to secure financing. In short, Russia was suffering from ‘stagflation,’ a dangerous combination of high inflation and falling GNP.

Russia’s condition seemed to stabilize somewhat after 2015, although the country remained much weaker economically than before sanctions were imposed. Interest rates had fallen to 11% by the end of 2015, and 9.25% by April 2017. However, the medium-term prognosis remains weak. For example, the net profit reported by Gazprom fell 86% from 2013 to 2014 (2015, ‘Gazprom profits hit by weak rouble,’ BBC News, 29 April). The stock market fell again, before recovering somewhat. The RTS index stood at 736 on January 6, 2016, before rising above 1000 by early 2017. Similarly the ruble, which had recovered somewhat by mid-2015, fell again later in the year. By January 2016 it stood at levels similar to those seen in the crisis of December 2014. Although it has gradually recovered since then, it has still lost about half its value compared to pre-crisis levels. Thus it is clear that the sanctions (along with declines in oil prices) have had an effect, imposing costs on Russia and thus weakening its ability to project economic power in its own right. For example, with depleted foreign currency reserves, the country is less able to offer loans to favored states, and with Gazprom losing profitability, it is less able to manipulate prices for political reasons. Such results can be considered a ‘success’ by those favoring sanctions.

Finally, we must consider the third factor in the sanctions’ impact: will they affect President Putin’s domestic popularity? There is some evidence that this has begun to happen. Other political parties in Russia’s tightly controlled ‘bloc party system,’ in which the "opposition" parties almost always vote with Putin, have begun to balk in some cases. In October, 2014, for example, Putin was barely able to get the normally-compliant Russian Parliament to pass a bill compensating rich oligarchs whose overseas property was expropriated by Western sanctions. The vote was only 232-202, with all parties other than Putin’s United Russia voting against. This unexpectedly strong opposition was linked to resentment over the fact that economic problems could lead to cuts in popular programs, such as government grants given to families having children. One Liberal Democratic Party lawmaker was quoted as saying 'why should we compensate people with yachts on the Côte d’Azur when we can’t support unborn children?' (Rudnitsky & Meyer 2014)

The Russian people, too, are beginning to raise questions as economic pressure grows. For example, some Russian companies—and the state itself—have now returned to a deeply unpopular tactic rarely seen since the Yeltsin years: delaying payment of workers’ wages, sometimes for months. As an April 2015 article in The New York Times documented, desperate workers scattered across the country—from teachers in the Far East to autoworkers near the Estonian border—had begun to launch small-scale strikes and protests over this issue (Kramer, 2015). When economic decline reaches this point, political discontent seems likely to rise, eventually. Recent opinion polls in Russia have reflected this change. Putin’s party, United Russia, was favored by about 45% of voters before the 2014 crisis. In spring and summer of 2014 this jumped suddenly to about 60%. However, it has since drifted downward, and as of May-June 2016 had returned to about 45% (Russian Public Opinion Research Center). Nonetheless, United Russia was still able to prevail in the Duma elections held in September, 2016. Clearly, some of the ‘rally round the flag’ effect predicted by Galtung (1967) and Eland (1995) remained.

- 1.This piece will consider both economic sanctions and incentives under the same umbrella, as opposite sides of the same coin. Some literature refers to sanctions and incentives separately, while other authors label these as ‘negative’ and ‘positive’ sanctions. See the discussion in Newnham (2002), Ch. 1.

- 2.While the literature has innumerable studies of these cases, sanctions by non-Western actors are much more rarely considered. For example, this bias is seen even in the most authoritative study of sanctions (Hufbauer, et.al., 2007). This work focuses on 174 cases of sanctions since 1914. Yet over two-thirds of the cases chosen involve the U.S. as initiating country (118 out of 174). When cases initiated by the E.U. countries are included, we see that 145 of 174 cases (over 83%) are Western-based.

- 3.On Germany see the classic study by Hirschman (1945). On Japan see Copeland (2014), Chapter 4.

- 4.A well-known example, for instance, is the lengthy economic battle to influence Egypt. America first planned to help fund the Aswan Dam, but then the USSR took over the project, cementing its influence in Egypt at the time. Later the US again became Egypt’s dominant aid provider—and the dominant political influence in the country (Burns, 1985).

- 5.See for example the classic debate between Pape (1997) and Elliott (1998).

- 6.Many opinion polls have confirmed that Putin’s approval rating in Russia skyrocketed after the crisis began. For example, a February 2015 survey by the Levada Center showed that 86% of Russians approved of Putin (Ahmed, 2015).

- 7.For example, after ten years in the E.U., it was estimated that Poland alone had received about $30 billion in farm subsidies and close to $70 billion in other development subsidies. When one considers that a similar amount was budgeted for the 2014-20 period, one author described this as roughly “double the Marshall Plan” (Ministry of Treasury, Republic of Poland 2014, and Adkoya, 2014).

- 8.To some extent this is now occurring, as Ukraine’s Association Agreement with the E.U. takes effect. For example, a number of factories have already opened in Western Ukraine, using local labor (at salaries about 1/8 those in the E.U.) to produce products for the European market (Kramer, 2016). Of course, as will be discussed below, any such gains must be balanced against the costs of declining access to Russian markets.

- 9.According to World Bank figures, in 1992 Poland’s GNI per capita was $2,040, slightly larger than the $1,420 estimated for Ukraine. However, by 2013 Poland’s GNI was $13,480 per person while Ukraine’s was only $3,800. Poland was almost four times more wealthy. Since then, Ukraine’s economy has worsened greatly, tilting the ratio further in Poland’s favor. In 2015 Polish GNI per capita stood at $13,310 and Ukraine’s had dwindled to $2,640, meaning typical Poles were over five times better off than their eastern neighbors. All figures from http://data.worldbank.org.

- 10.In fact, the final collapse of the regime was precipitated in large part by its loss of authority in Western Ukraine, notably the seizure of thousands of weapons from police stations in the Lviv area on February 18, 2014.

- 11.As an example of how difficult this process will be, however, the Union decided to postpone full implementation of the trade accord until 2016 after Russia threatened to close its market to Ukrainian goods if the agreement went ahead.

- 12.In 2013 the Ukrainian GDP at official exchange rates was only $175.5 billion, while Russia’s stood at $2.113 trillion, 12 times larger (figures from the CIA World Factbook).

- 13.This act was named for Sergei Magnitsky (a Russian lawyer working for American investor Bill Browder), who died in detention in 2009. Magnitsky had been jailed as part of what most observers believed was a trumped-up investigation into Browder’s firm. The U.S. law imposed travel bans and asset freezes on 18 Russians involved in the Magnitsky case, and Russia promptly banned 18 Americans (Shevtsova and Kramer, 2012).

- 14.There are certainly exceptions: Poland and the Baltic states, for example, for obvious historical and geographic reasons, are much more worried about the Russian threat than states such as Italy, Greece and Spain.

- 15.Alexei Navalny, widely seen as Putin’s most credible opponent at home, also now believes that there is no real chance for Crimea to return to Ukraine (Mackey, 2014).

- 16.Prices on some items reportedly almost doubled in 2014-15, due both to increased scarcity and the fall of the ruble against other currencies. For example, coffee jumped almost 80%, carrots 75%, and tea almost 70% (Tavernise, 2015).

- 17.Figures are 2014 estimates of GNP at official exchange rates, from CIA World Factbook. Available from: http://www.cia.gov.

- 18.The IMF data on foreign exchange reserves worldwide (first quarter 2015) shows the U.S. dollar making up 64.1% of reserves and the euro 20.7%. Adding the yen, pound, and Australian and Canadian dollars gives a Western share of reserves of at least 96.7%. (International Monetary Fund, Current Composition of Official Foreign Exchange Reserves (COFER). Available from: http://www.imf.org.

- 19.International Monetary Fund, World Economic Outlook Database. Available from: http://www.imf.org.

- 20.The U.S. led the world with some $2.38 trillion in imports in 2014. CIA World Factbook. Available from: http://www.cia.gov.

- 21.In 2013 the U.S. gave $31.55 billion in Official Development Assistance (ODA), more than any other state. Equally importantly, virtually all of the other major donors are U.S. allies, meaning that a coordinated Western increase or decrease in aid to a targeted country would be very effective. OECD, Net ODA from DAC and Other Donors in 2013. Available from: http://www.oecd.org.

Join the Discussion!